By: Frank Lauletta

The Tax Cuts and Jobs Act of 2017 was enacted on December 22, 2017. The Act included Internal Revenue Code §1400Z, which provides tax incentives for investments in qualified Opportunity Zones through investment vehicles called Qualified Opportunity Funds. These funds are designed to encourage investments into low-income communities, which are designated by the state as Qualified Opportunity Zones.

The number of Qualified Opportunity Zones may equal up to 25 percent of the number of low-income communities within that state. However, if there are less than 100 low income communities, then a total of 25 tracts may be designated as Qualified Opportunity Zones. Up to five percent of the tracts designated in a State may be non-low-income communities if the tract is both contiguous with the low-income community and the median family income of the tract does not exceed 125 percent of the median family income of the low-income community. In New Jersey, there are 169 opportunity zones, which in southern New Jersey include Camden, Deptford, Woodbury, Lindenwold, Pine Hill, Carneys Point, Egg Harbor City, Glassboro, Salem, Vineland, Egg Harbor Township, Bridgeton, Millville, Pleasantville, Atlantic City, Somers Point, Lower Township and Wildwood.[1]

If an investor realizes a gain from a sale or exchange of a capital asset from an unrelated party, the investor may defer realization and taxation if, within 180 days from the date of such sale or exchange, the investor reinvests the gain amount with a cash investment into a Qualified Opportunity Fund. A Qualified Opportunity Fund is an investment vehicle that must hold at least 90 percent of its assets in designated Qualified Opportunity Zone properties. Opportunity zone property means property which is an opportunity zone stock, an opportunity zone partnership interest, or an opportunity zone business property. A qualified opportunity zone business property means tangible property used in a trade or business if (i) such property is acquired after December 31, 2017, (ii) the fund substantially improves [2] the property, and (iii) substantially all of the use of the property is in a Qualified Opportunity Zone.

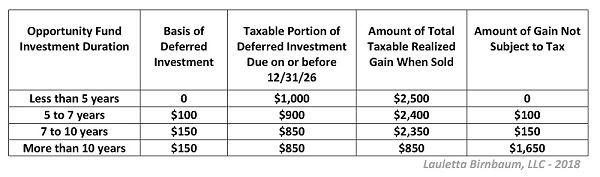

The tax advantages are three-fold. First, the tax that would otherwise be payable in connection with the sale of the prior capital asset is deferred until either the date the opportunity investment is sold or exchanged or December 31, 2026, whichever date comes first. As part of the deferral, the basis assigned to the replacement Qualified Opportunity Zone property starts at $0. However, the second advantage allows this basis to increase based upon the duration of the investment in the Qualified Opportunity Fund. If the investment is held for at least 5 years, the basis will increase by 10 percent of the amount of gain deferred. If the investment is held for at least 7 years, the basis will increase an additional 5 percent or 15 percent of the deferred amount in total.

The amount to be included will be the lesser of the deferred amount or the fair market value (if a “loss” is taken) minus the taxpayer’s basis, shown above. The applicable taxes due on the deferred investment will be due no later than December 31, 2026. This date is a hard deadline and is essential for investors to take full advantage of the tax break. Therefore, to be awarded the full 10 percent break, the investment must be paid into the fund by 2021. Respectively for the additional 5 percent, the investment must be in the fund by 2019.

The third tax advantage is realized if the taxpayer holds Opportunity Zone Property in the Opportunity Fund for at least 10 years. If this is the case, then the basis of the Opportunity Zone Property will be the fair market value on the date it is sold. This means that no additional capital gains tax, beyond what is due on December 31, 2026, will be due when the taxpayer sells the Opportunity Zone Property.

Example:

Deferral of Gain Invested in Opportunity Zone Property = $1,000

Fair Market Value of Opportunity Zone Property = $2,500

- This rule applies to an amount up to, but not exceeding, the amount of the capital gain. For example, if the capital gain is $1 million but the investor invests a total of $2 million in a Qualified Opportunity Fund, he or she may only defer up to $1 million

- Investors can take advantage of the tax deferral only once for any given unrelated investment. Using the same example above, if an investor has a capital gain of $1 million, he or she could invest $500,000 in a Qualified Opportunity Fund and defer that amount but could not invest and defer the remaining $500,000 at a later time

- Investments must be made within 180 days of the sale or exchange that produced the capital gain.

- The sale or exchange that produced the capital gain must be with an unrelated party

- Investments in Opportunity Zone Property must be made before December 31, 2026

For more information about this new law, call Frank Lauletta or Lloyd Birnbaum at 856-232-1600.

[1] The following link contains a map of the New Jersey Designated Opportunity Zones:

https://www.state.nj.us/dca/divisions/lps/pdf/Statewide_Designated_Opportunity_Zones_Map.pdf

[2] “Substantially improves” means that the investor must invest an amount equal to or greater than the cost to initially acquire the property. In other words, at least 50% of the total investment amount must be used toward improving the property.